Banks have stepped back.

We've stepped in.

Stable provides independent, relationship driven financial guidance to UK SMES — offering comprehensive finance coverage, cost comparisons, and access to products that help your business grow.

One place, multiple solutions, personalised support

Over 15 years providing financial services for UK SMEs

The founding team at Stable noticed a quick and continued retracement from traditional banks providing service to UK SMEs. Stable was born to give SME owners and Finance managers the time and confidence that they have the right tools available for their continued success.

Three ways we save your company both time and money.

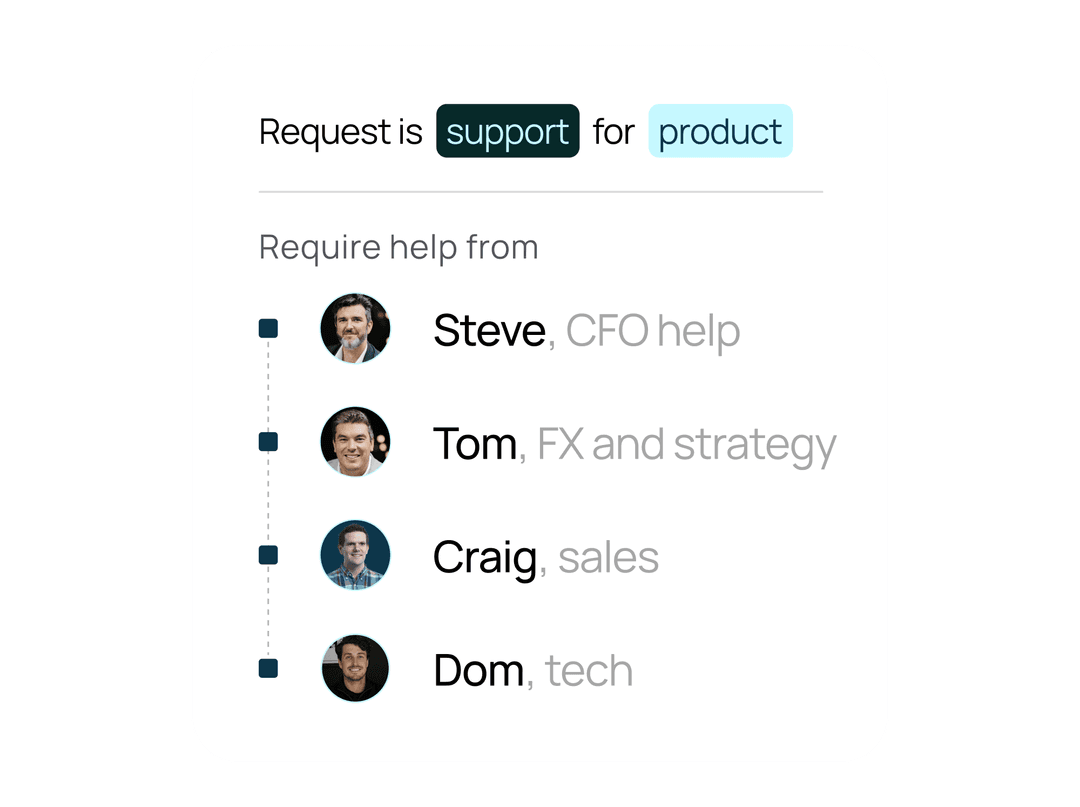

Bespoke, relationship led guidance

Whole Market Perspective

Stable takes an outsiders view of your finance function, bringing experience across our key sectors we can give you all of the options, not just the ones your current bank can do.

Cut out the jargon

Get a view based on your needs and your business- not some generic product link.

For UK SMEs who are time poor and ambitious

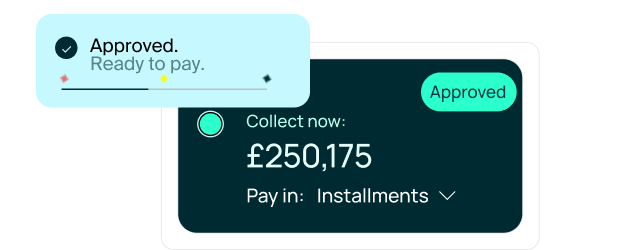

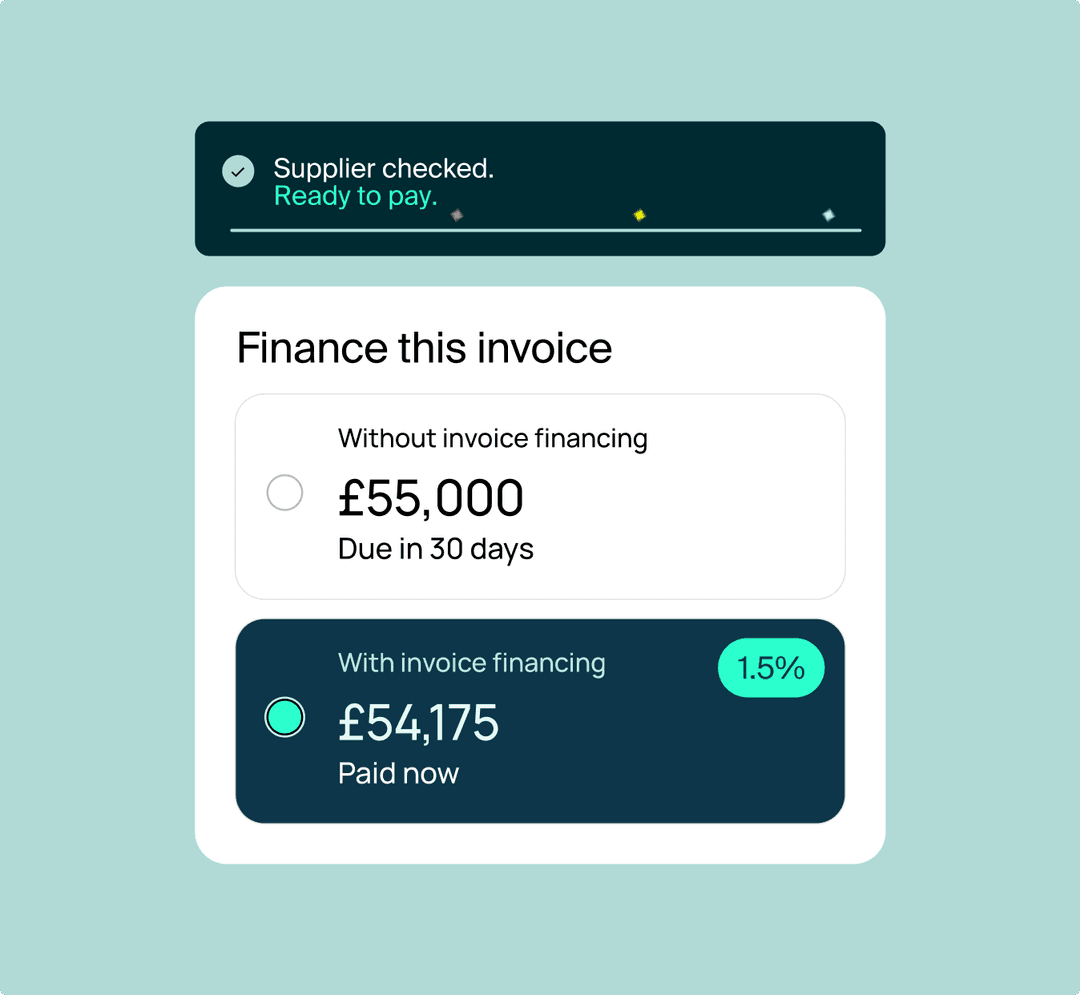

Range of options

Stable are connected to a wide array of the market, meaning they stay on top of available options and do the heavy lifting for you.

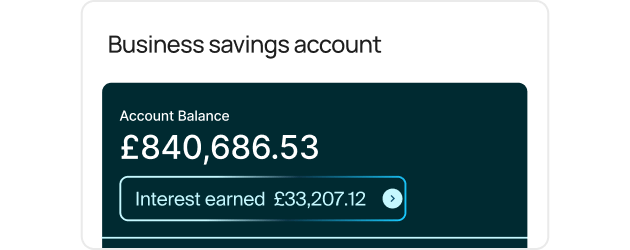

Cost Saving

Typically Stable identify additional revenue levers or cost reductions that go straight to bottom-line.

Time Saving

Stable do the heavy lifting for you, presenting a concise and well balanced range of options, freeing you up to work on your business.

Personalised Tech

Stable utilise cutting edge technology to provide a personalised service, ensuring you are getting the best possible rate and terms for your business.

Don't just take our word for it.

We're giving businesses access to the best rates

No hidden fees, no surprise costs. Just straightforward, transparent pricing.

Loan Calculator

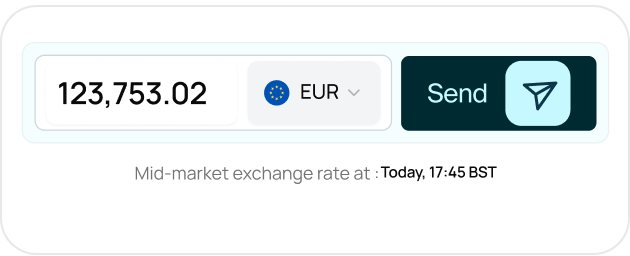

FX Calculator

Merchant Calculator

Latest in finance news

Introducers & Partnerships - Strategic Partnerships That Work

Stable partners with trusted advisers — from accountants to wealth managers — offering a value-add for your clients, and a new income stream for your business.

We partner with:

- Equestrian

- Accountants

- Wealth Advisors

- Buying Groups

- Private Equity PM

- Family Office PM

- Equestrian

- Accountants

- Wealth Advisors

- Buying Groups

- Private Equity PM

- Family Office PM

- Equestrian

- Accountants

- Wealth Advisors

- Buying Groups

- Private Equity PM

- Family Office PM

Add value for clients

Additional Revenue streams

Valued and trusted delivery partner